Comparing performance of listed v/s unlisted commodities

Primer on my investment outlook

United States

The run-up in commodity prices may have negative implications for stocks in the materials sector. We have previously noted that speculators have record net-long positions in a broad range of commodities, and we have suggested that commodity prices recently have been driven as much by speculation as by fundamentals. Our new research shows that commodity speculation is close to an historical high. When speculation rose to similar levels in the past, commodity prices always declined on a year-to-year basis in the subsequent 12 months.

If history repeats itself, it appears as though metals and mining stocks might be the most susceptible to a decrease in commodity prices; chemical stocks also appear to be vulnerable, but to a lesser extent. Investors who want exposure to the materials sector along with some shielding from commodity price declines should probably shift toward the containers-and-packaging and paper-and forest- products groups. To separate the effects of possible speculative activity from fundamental activity, we compared the spot-price movements of commodities that have listed futures with those of commodities that do not.

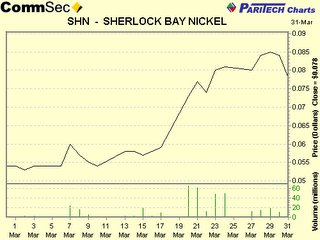

Our assumption is that speculators are more willing to act through the liquid futures markets than they are by purchasing a physical commodity or by purchasing an illiquid OTC forward contract. If the spot prices of listed commodities appreciate or depreciate abnormally in relation to those that do not have listed futures, it might be reasonable to assume that speculative activity, rather than economic fundamentals, has caused the difference in performance between the two commodity groups. We have divided the component commodities of the Journal of Commerce–ECRI Industrial Commodities Price Index (JOCIINDX on Bloomberg) into commodities with listed futures and those without. The chart above shows the average 12-month performance during the past 14 years of the spot prices of our group of exchange-listed commodities vs. that of our unlisted commodities. Speculative periods are clearly evident; the highest level of speculation was in January 2006. (Interestingly, there are also similarly clear periods of risk aversion.)

Peaks in commodity prices appear to coincide with peaks in our gauge of speculative activity. Indeed, commodity prices have always fallen in the 12 months after the spot prices of our exchange-listed commodities have outperformed those of the unlisted commodities by 15 percentage points or more: there were 19 instances in the history we studied in which the performance spread was 15 per cent or more, and the JOC-ECRI index provided negative returns subsequent to each instance. That suggests that the outlook for commodities for the next 12 months is not very encouraging because the current spread (31 per cent) is well-above the 15-percentage-point level. Implications for Materials Stocks Perhaps because the current environment for commodities is quite speculative, the materials sector has been the bestperforming sector in the S&P 500 during the past six months. It has risen by 25 per cent or so, about 50 per cent more than telecom, the runner-up.

Investors are assuming that commodities will continue to appreciate. The Merrill Lynch Fund Managers Survey shows that only 25 per cent of fund managers believe that commodity prices will be lower 12 months from now, and 42 per cent believe that commodities will appreciate by at least 5 per cent. However, if our analysis is correct, investors should probably consider reducing positions in materials stocks and/or shifting to those industries within the sector that have not been so significantly influenced by commodity speculation. A quick look at the materials sector shows that the metals and mining group appears to be the most sensitive to the JOCECRI index with a beta of 0.92. Underfollowed industries in the materials sector such as containers and packaging and paper and forest products seem to have lower correlations.

Richard Bernstein

U.S. Strategist, MLPF&S

United States

The run-up in commodity prices may have negative implications for stocks in the materials sector. We have previously noted that speculators have record net-long positions in a broad range of commodities, and we have suggested that commodity prices recently have been driven as much by speculation as by fundamentals. Our new research shows that commodity speculation is close to an historical high. When speculation rose to similar levels in the past, commodity prices always declined on a year-to-year basis in the subsequent 12 months.

If history repeats itself, it appears as though metals and mining stocks might be the most susceptible to a decrease in commodity prices; chemical stocks also appear to be vulnerable, but to a lesser extent. Investors who want exposure to the materials sector along with some shielding from commodity price declines should probably shift toward the containers-and-packaging and paper-and forest- products groups. To separate the effects of possible speculative activity from fundamental activity, we compared the spot-price movements of commodities that have listed futures with those of commodities that do not.

Our assumption is that speculators are more willing to act through the liquid futures markets than they are by purchasing a physical commodity or by purchasing an illiquid OTC forward contract. If the spot prices of listed commodities appreciate or depreciate abnormally in relation to those that do not have listed futures, it might be reasonable to assume that speculative activity, rather than economic fundamentals, has caused the difference in performance between the two commodity groups. We have divided the component commodities of the Journal of Commerce–ECRI Industrial Commodities Price Index (JOCIINDX on Bloomberg) into commodities with listed futures and those without. The chart above shows the average 12-month performance during the past 14 years of the spot prices of our group of exchange-listed commodities vs. that of our unlisted commodities. Speculative periods are clearly evident; the highest level of speculation was in January 2006. (Interestingly, there are also similarly clear periods of risk aversion.)

Peaks in commodity prices appear to coincide with peaks in our gauge of speculative activity. Indeed, commodity prices have always fallen in the 12 months after the spot prices of our exchange-listed commodities have outperformed those of the unlisted commodities by 15 percentage points or more: there were 19 instances in the history we studied in which the performance spread was 15 per cent or more, and the JOC-ECRI index provided negative returns subsequent to each instance. That suggests that the outlook for commodities for the next 12 months is not very encouraging because the current spread (31 per cent) is well-above the 15-percentage-point level. Implications for Materials Stocks Perhaps because the current environment for commodities is quite speculative, the materials sector has been the bestperforming sector in the S&P 500 during the past six months. It has risen by 25 per cent or so, about 50 per cent more than telecom, the runner-up.

Investors are assuming that commodities will continue to appreciate. The Merrill Lynch Fund Managers Survey shows that only 25 per cent of fund managers believe that commodity prices will be lower 12 months from now, and 42 per cent believe that commodities will appreciate by at least 5 per cent. However, if our analysis is correct, investors should probably consider reducing positions in materials stocks and/or shifting to those industries within the sector that have not been so significantly influenced by commodity speculation. A quick look at the materials sector shows that the metals and mining group appears to be the most sensitive to the JOCECRI index with a beta of 0.92. Underfollowed industries in the materials sector such as containers and packaging and paper and forest products seem to have lower correlations.

Richard Bernstein

U.S. Strategist, MLPF&S