Uranium blowoff

Primer on my investment outlook

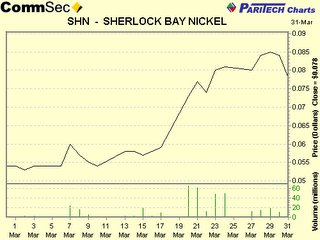

SHN - Sherlock Bay nickel prices have gone crazy the past few days, and might rise more, as the stock is pending an announcement. Australia announced an agreement with China allowing China to buy uranium. A lot of speculative money flew into uranium stocks, and SHN was the beneficiary. Since my basis cost is less than 4c a share, i'm sitting tight and enjoying the run.

For perspective, here is an excerpt from an interview at www.miningnews.net

* SHERLOCK BAY NICKEL

Share price (at March 17): 5.9c

Market cap (at March 17): $40.17 million

1. Where is your mainstay project located?

Mt Salt is located 80km west of Karratha. Copper Bore Well is located 100km south of Onslow.

2. When was it discovered?

Mt Salt's radioactivity potential was first referenced in geological literature by AG Spence in 1962. Copper Bore Well was a target of ESSO in the 1970's.

3. What is the company's stake in the project?

Both are owned 100% by Sherlock Bay Nickel Corporation and are currently exploration licence applications (ELA's).

4. What work programs have been completed at the project? How much drilling has been carried out?

Mt Salt - Airborne magnetic and radiometric survey, rock chip sampling, scintillometer traverse, geometrics gamma ray spectrometer traverse, geochemical sampling, spectrometer surveys and broad spaced drilling.

5. What style/type of uranium mineralisation is at the project?

The potential exists for one of three deposits – a cretaceous uranium roll front deposit, a cretaceous unconformity style uranium deposit or a proterozoic basement Jabiluka-Ranger style uranium deposit.

6. What are the dimensions of the mineralisation? What are the levels/tenor/grade of mineralisation?

AGSO airborne uranium channel anomaly system has dimensions some 20km in strike and 4-5 km in width.

7. Is the project essentially a 'greenfields' proposition, or does it have a JORC-compliant resource? If it is not 'greenfields' and if it doesn't have a JORC resource, how much work needs to be done in order to establish one?

Greenfields proposition.

8. What is the potential size of the deposit?

Too early to estimate.

9. How much cash has the company budgeted to spend on the ground at the project during 2006?

Still an application so no funding allocated in 2006.

10. What is the company's current cash position?

As at December quarter the cash position was $3.8 million.

11. Which contractors/consultants has the company been/intend using?

Not yet determined.

12. How is the project located in terms of infrastructure?

N/A

13. How far away is a potential development? What is the potential size and timeline?

N/A

14. What are the potential capital/operating costs of the development? When will you likely know?

N/A

15. What are the main hurdles to reaching a development decision?

N/A

SHN - Sherlock Bay nickel prices have gone crazy the past few days, and might rise more, as the stock is pending an announcement. Australia announced an agreement with China allowing China to buy uranium. A lot of speculative money flew into uranium stocks, and SHN was the beneficiary. Since my basis cost is less than 4c a share, i'm sitting tight and enjoying the run.

For perspective, here is an excerpt from an interview at www.miningnews.net

* SHERLOCK BAY NICKEL

Share price (at March 17): 5.9c

Market cap (at March 17): $40.17 million

1. Where is your mainstay project located?

Mt Salt is located 80km west of Karratha. Copper Bore Well is located 100km south of Onslow.

2. When was it discovered?

Mt Salt's radioactivity potential was first referenced in geological literature by AG Spence in 1962. Copper Bore Well was a target of ESSO in the 1970's.

3. What is the company's stake in the project?

Both are owned 100% by Sherlock Bay Nickel Corporation and are currently exploration licence applications (ELA's).

4. What work programs have been completed at the project? How much drilling has been carried out?

Mt Salt - Airborne magnetic and radiometric survey, rock chip sampling, scintillometer traverse, geometrics gamma ray spectrometer traverse, geochemical sampling, spectrometer surveys and broad spaced drilling.

5. What style/type of uranium mineralisation is at the project?

The potential exists for one of three deposits – a cretaceous uranium roll front deposit, a cretaceous unconformity style uranium deposit or a proterozoic basement Jabiluka-Ranger style uranium deposit.

6. What are the dimensions of the mineralisation? What are the levels/tenor/grade of mineralisation?

AGSO airborne uranium channel anomaly system has dimensions some 20km in strike and 4-5 km in width.

7. Is the project essentially a 'greenfields' proposition, or does it have a JORC-compliant resource? If it is not 'greenfields' and if it doesn't have a JORC resource, how much work needs to be done in order to establish one?

Greenfields proposition.

8. What is the potential size of the deposit?

Too early to estimate.

9. How much cash has the company budgeted to spend on the ground at the project during 2006?

Still an application so no funding allocated in 2006.

10. What is the company's current cash position?

As at December quarter the cash position was $3.8 million.

11. Which contractors/consultants has the company been/intend using?

Not yet determined.

12. How is the project located in terms of infrastructure?

N/A

13. How far away is a potential development? What is the potential size and timeline?

N/A

14. What are the potential capital/operating costs of the development? When will you likely know?

N/A

15. What are the main hurdles to reaching a development decision?

N/A

0 Comments:

Post a Comment

<< Home